What a difference a day makes: inequality and the tax and benefit system from a long-run perspective

Published in The Journal of Economic Inequality, 2017

Abstract

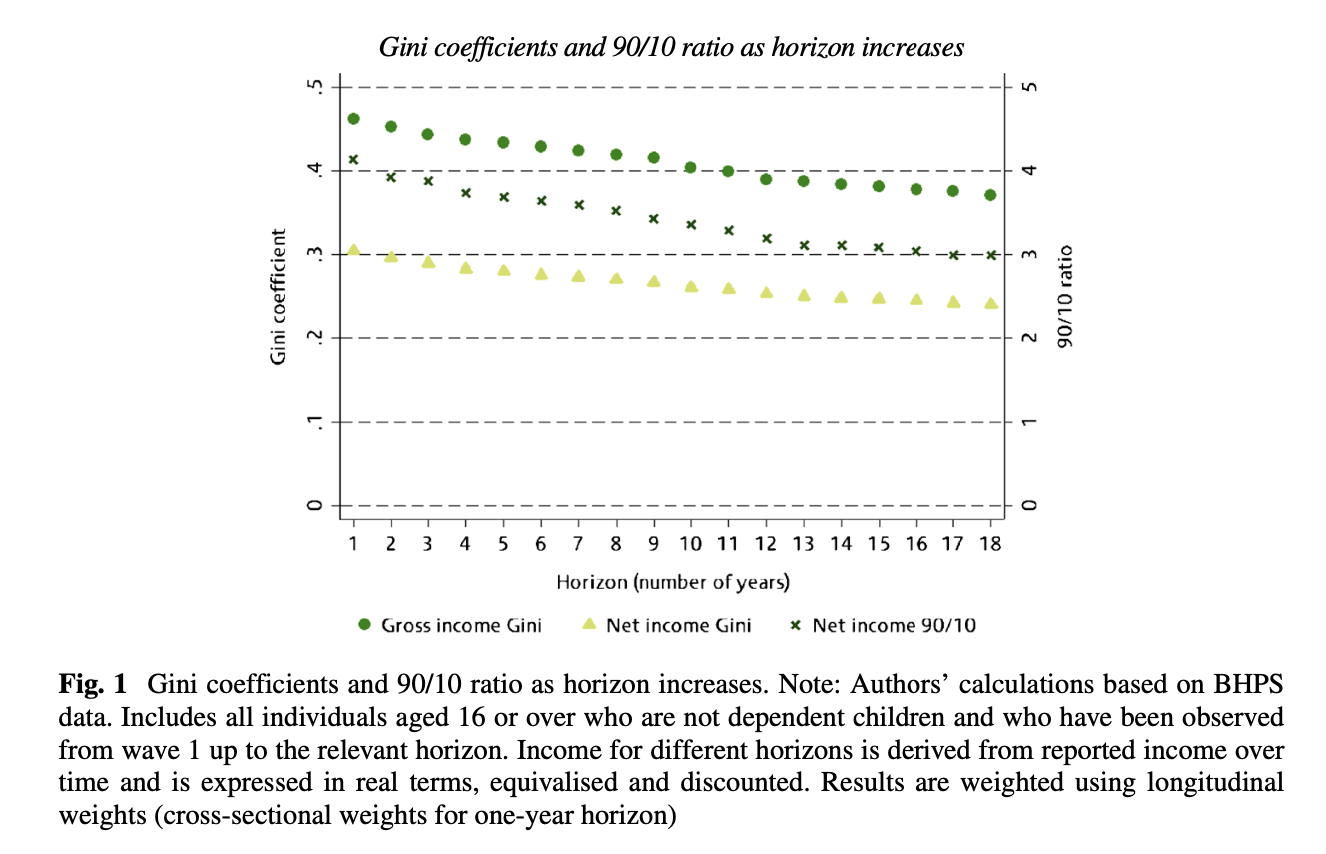

This paper examines the lifetime distributional impact of changes to the tax and transfer system. We find that—in contrast to standard snapshot analyses—increases to work-contingent benefits are just as effective at redistributing resources to the lifetime poor as increases to out-of-work benefits. This has important implications for the equity-efficiency trade-off typically thought to apply to work-contingent transfers. We also show that increases to higher rates of income tax are an effective way of targeting the lifetime rich because higher earners tend to exhibit greater persistence in their incomes. Our results illustrate the importance that moving beyond an exclusively snapshot perspective can have when analysing tax and transfer reforms.

Recommended citation: Barra Roantree, Jonathan Shaw, "What a difference a day makes: inequality and the tax and benefit system from a long-run perspective." The Journal of Economic Inequality, 2017.

Download Paper