Frictions and taxpayer responses: evidence from bunching at personal tax thresholds

Published in International Tax and Public Finance, 2020

Abstract

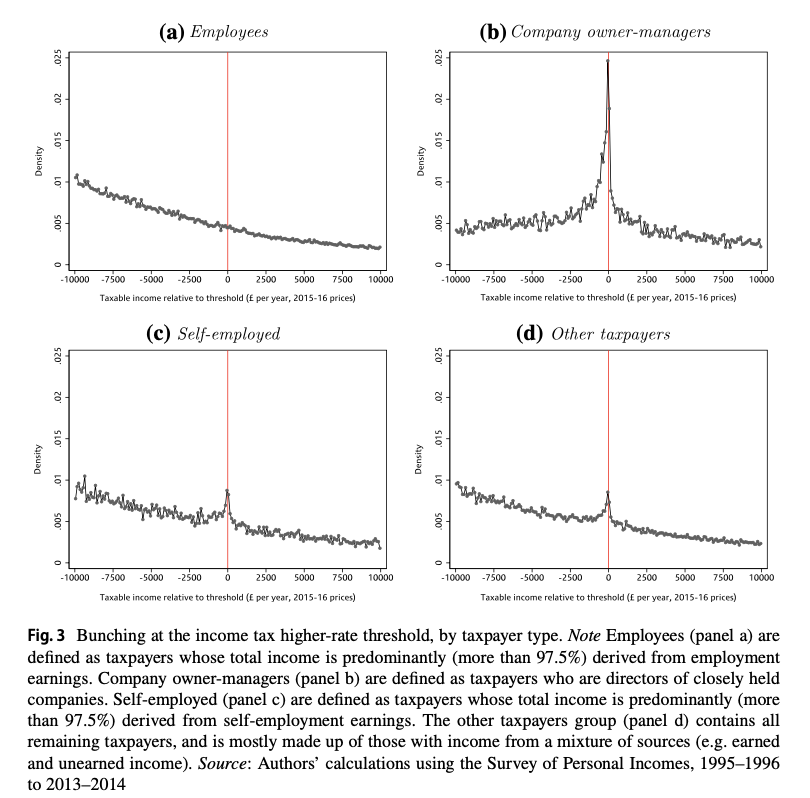

We exploit kinks and notches in the UK personal tax schedule over a 40-year period to investigate how taxpayers respond to income tax and social security contributions. At kinks, where the marginal rate rises, we find bunching by company owner-managers and the self-employed, but not those with only employment income. Responses to notches, where the average rate rises, provide compelling evidence that this is because most employees face substantial frictions: fewer than a quarter bunch even where doing so would increase both consumption and leisure. We develop a new approach for identifying selection in who responds and for decomposing responses into hours and wage components. We find that those employees who do bunch at notches are almost exclusively part-time workers, but tend to have lower wages and work more hours than those part-time workers who do not bunch.

Recommended citation: Stuart Adam, James Browne, David Phillips, Barra Roantree, "Frictions and taxpayer responses: evidence from bunching at personal tax thresholds." International Tax and Public Finance, 2020.

Download Paper